The Financial Value of Brands Continues to Rise

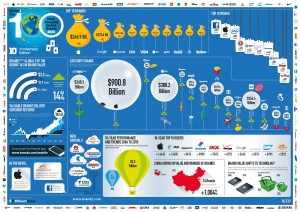

Brands continue to grow in value, according to the analyses in Millward Brown‘s most recent BrandZ Top 100 Most Valuable Global Brands report.

Although I maintain my previously-expressed concerns with all brand valuation methodology — whether it is Interbrand’s Best Global Brands, BrandFinance Global 500, or Millward Brown’s BrandZ — the dollar values they report are helpful on relative basis and the analyses that accompany the rankings usually reveal important trends in brand-building. Millward Brown’s report this year conveyed a treasure trove of brand insights and developments.

The seven brand trends that stood out to me the most are:

- Strong brands continue to produce quantifiable financial value. Millward Brown shows that in the last 10 years, the BrandZ Strong Brands portfolio (the strongest brands in the BrandZ Top 100 Most Valuable Global Brands list) has increased in value by 102.6%. In contrast, the MSCI World Index, a weighted index of global stocks, has appreciated by only 30%. That means, if you were to have invested $100 in the BrandZ portfolio 10 years ago, it would be worth $203 today vs. $130 if you had invested in the MSCI.

- Facebook remains a powerful force. Its brand value almost doubled from $35.7 billion in 2014 to $71.1 billion in 2015 — and that increase was on top of a 68% rise a year earlier. Facebook led the top year-over-year risers thanks to key acquisitions such as What’sApp that kept the brand relevant with younger users, an improved mobile presence, and advertising sales growth.

- Fast food is on the rise. The fast food category led all categories in brand value growth over the past decade, with an increase of 252%. (The next biggest gainer was beer at 183%). This increase was driven in part by newer, innovative brands, like Panera and Chipotle, which was not in the fast food category ranking in 2006 when the BrandZ Global Top 100 Brand report launched. Millward Brown also attributed the 10-year industry growth trend to McDonald’s grew significantly in the 00’s and still managed to rank in the top 10 in 2015 (despite dropping from $85.7 billion in 2014 to $81.1 billion).

- Technology now rules the brand roost. Four of the BrandZ Global Top 5 most valuable brands in 2015 are in technology — Apple, Google, Microsoft, and IBM. And five of the 10 Top Riser brands — Apple, AT&T, Verizon, Google, and SAP — come from the technology or telecom providers categories. Driven by Apple’s leadership, the influx of mostly-tech Chinese brands, and B2B tech brands that showed financial improvement following several years of transitioning complicated global enterprises to the cloud, technology’s ascendance to Top 10 domination came at the expense of banks, cars, and retail.

- Asian brands — specifically those from China — have become legitimate players in the brand world. Ten years ago only one Chinese brand ranked among the BrandZ Global Top 100 – China Mobile, a state-owned telecoms provider. Today 14 Chinese brands are on the list. The Chinese e-commerce brand Alibaba entered the BrandZ Top 100 for the first time in 2015, starting in first place in the retail category.

- Brand salience — the ability of a brand to come to mind spontaneously — has grown in importance in driving brand power. According to the consumer surveys that Millward Brown conducted in conjunction with its brand valuation analysis, the top brands in 2015 are rated lower than in past years for being Different (unique and trend-setting in a positive way) and Meaningful (fulfills consumer needs in relevant ways), but higher for being Salient. The firm attributed this dynamic to the evolving composition of the Top 100 brand list, with newcomers scoring higher than dropout brands. It may also simply reflect that meaningful differentiation has become more difficult to achieve, but iconic brands still manage to stand out.

- Brand-building efforts focused on brand positioning and identity produce greater returns than advertising alone. Brand consultancies The Partners and Lambie-Nairn collaborated with Millward Brown to study how brand-building activities drive growth in brand value. Their analysis found that superior brand value and the greatest brand value growth occur when brands deliver the combination of a unique and compelling core proposition, a distinctive brand identity, and great advertising. Brands that scored highly on all three criteria over the last 10 years produced brand value growth on average of 168%. But when consumers perceive a brand to have great advertising but a weaker proposition and identity, brand value grew only 27%.

The report contains more provocative insights about

- differentiation

- innovation

- brand purpose

I encourage you to take a look at it.

related: